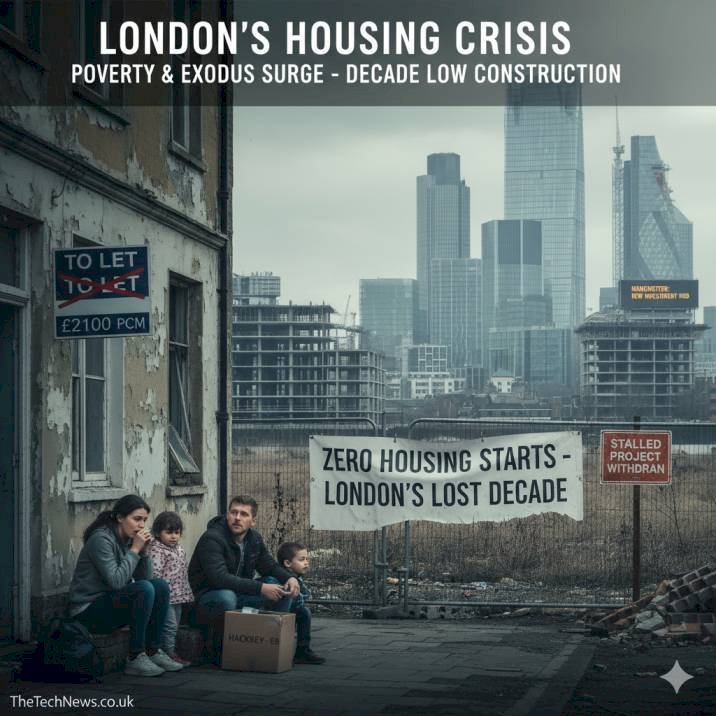

London’s Housing Crisis Hits Decade Low as Poverty and Exodus Surge

London is building less than 5% of its annual housing target, with developers retreating amid high costs and planning delays. Rents soar, child poverty doubles, and investment confidence collapses.

London’s housing crisis has plunged to its worst level in over a decade. New figures show that construction has virtually ground to a halt, rents are at record highs, and families across the capital are being priced out of secure homes. With only a fraction of housing targets met in 2025, experts warn the crisis is fuelling rising poverty, deepening inequality, and driving talent out of the city.

Homebuilding Collapse: A City Falling Behind

In the first nine months of 2025, only 3,248 homes started construction across London — less than 5 percent of the government’s annual target and just 11 percent of the city’s recent average, according to the Home Builders Federation (HBF). To meet housing demand, London needs around 88,000 new homes a year, yet the supply gap keeps widening.

Developers are retreating from projects faster than at any point since the post-Grenfell safety reforms. High construction costs, complex planning regulations, and rising interest rates have rendered many schemes unviable.

“Developers are walking away because the numbers don’t work anymore,” said a senior HBF spokesperson. “London has become a no-go zone for housing investment.”

That warning is backed by data: more than 70 percent of London boroughs recorded zero housing starts in early 2025. Analysts say the capital is now delivering fewer homes than at any point in the past ten years — a trend that threatens both affordability and investor confidence.

Families and Children Under Pressure

Behind the statistics are the stories of thousands of Londoners struggling to keep a roof over their heads. The number of children living in poverty in the private rented sector has doubled over the past decade, now reaching 1.7 million nationally — with the capital hardest hit.

Research from Trust for London and the Resolution Foundation shows that nearly half of all children in private rented homes in London live in relative poverty after housing costs.

London also has the fastest rent increases in England, with the average monthly rent now exceeding £2,100. Over 60 percent of renters describe their housing costs as unaffordable. Poor living conditions add to the hardship: one in three Londoners reports damp, mould, or overcrowding at home.

For families like that of Sarah Malik, a teaching assistant from Hackney, the struggle is constant. “My rent went up £400 this year,” she said. “We’ve been on the social housing list for six years, and the flat we rent has mould on every wall. My kids are always coughing. It feels like we’re stuck.”

Health experts echo those concerns. “We’re seeing increasing respiratory illness and mental stress linked directly to poor housing conditions,” said Dr Emily Gardiner of King’s College London.

Economic Fallout: London’s No-Go Zone for Investment

The housing crisis is now spilling into London’s economy. The Home Builders Federation calls the capital a “no-go zone for investment,” warning that construction stagnation and policy uncertainty are deterring developers.

Data supports that claim. Several mid-sized developers have paused or cancelled projects, while construction sector employment in London has fallen 12 percent year-on-year. Major investors are shifting focus to Manchester, Birmingham, and Leeds, where planning processes are smoother and housing demand remains strong.

The consequences are widespread:

-

Thousands of construction and supply-chain jobs are at risk.

-

Public spending on homelessness has soared, with London councils now spending £4 million per day on temporary accommodation.

-

Businesses are relocating staff to regional offices as employees abandon the capital’s unaffordable housing market.

“London’s economy relies on the very people who can no longer afford to live here,” said Dr Elaine Porter, an urban economist at the London School of Economics. “If key workers, nurses, and teachers leave, the city’s social and economic foundations start to crack.”

Government Measures: Short-Term Fix or Long-Term Solution?

Faced with mounting pressure, both City Hall and Westminster have introduced emergency measures to revive construction.

In October 2025, the government launched a £322 million City Hall Developer Investment Fund to unlock stalled housing schemes and support new projects. The plan also includes temporary planning reliefs, levy reductions, and a controversial cut in the affordable housing requirement for new developments from 35 percent to 20 percent.

Officials say the move is a pragmatic response to restore confidence. “These changes are designed to get spades in the ground and homes built faster,” said a spokesperson from the Department for Levelling Up, Housing and Communities.

Critics disagree. Housing charities argue that lowering affordable housing quotas undermines the long-term solution to the crisis. “We might see more construction activity, but fewer affordable homes,” warned a Shelter UK representative. “It’s a short-term fix that risks deepening inequality.”

Analysts remain doubtful that the government’s broader pledge of 1.5 million new homes nationally by 2030 is achievable without structural change. The consensus across the industry is clear: planning reform, public investment, and a renewed focus on social rented housing are essential to turn the tide.

The Road Ahead: London at a Crossroads

Looking to 2026, housing experts predict that London’s construction output will remain below 10 percent of its target unless major policy reforms are enacted.

The consequences are already visible: soaring rents, rising homelessness, a shrinking workforce, and declining investor confidence. If left unaddressed, these pressures could push the capital into a “lost decade” of housing stagnation.

“This isn’t just a housing issue — it’s a question of London’s future,” said Dr Porter. “If we don’t act now, we’re creating a city where the next generation can’t afford to live, work, or raise families.”

For policymakers, the stakes could not be higher. The choices made in the next year will determine whether London rebuilds as an inclusive, livable city — or becomes one defined by division, displacement, and decline.

About TheTechNews.co.uk

thetechnews.co.uk is a trusted UK-based publication reporting on technology, business, and public policy. Our journalism explores how innovation, governance, and society intersect — from AI and fintech to housing, sustainability, and infrastructure.

We aim to inform, engage, and empower readers through evidence-based reporting and expert analysis. With accuracy and clarity at our core, TheTechNews connects technological change to real-world impact, offering readers a deeper understanding of the trends shaping the UK’s future.

Stay informed with thetechnews.co.uk — where technology meets truth.

Frequently Asked Questions (FAQ)

1. What is the current housing crisis in London in 2025?

London’s 2025 housing crisis refers to the severe shortfall in homebuilding across the capital. In the first nine months of 2025, only 3,248 new homes started construction — less than 5% of the government’s annual target. Developers have paused or abandoned projects due to rising costs, complex planning rules, and reduced buyer demand. The shortage has pushed rents to record highs and worsened affordability for thousands of families.

2. Why is London’s homebuilding rate so low?

London’s homebuilding rate is at a decade low because developers face multiple barriers: high construction costs, post-Grenfell safety regulations, expensive land, and slow planning approvals. Additionally, high interest rates have made borrowing for large developments harder, while uncertain government policies have deterred long-term investment.

3. How does the housing shortage affect child poverty?

The shortage of affordable homes has pushed more families into the private rented sector, where rents consume most of their income. As a result, the number of children living in poverty within the private rented sector has doubled in the past decade, reaching 1.7 million nationally. In London, nearly half of all children in private rentals live in relative poverty after housing costs, leading to health, educational, and social impacts.

4. What is the Developer Investment Fund announced in 2025?

The £322 million City Hall Developer Investment Fund, launched in October 2025, is a government initiative aimed at reviving stalled housing projects in London. It offers financial support and temporary planning reliefs to developers to accelerate construction. Critics argue, however, that it may not address the deeper issues of affordability or long-term housing supply.

5. Why has the Home Builders Federation called London a “no-go zone for housing investment”?

The Home Builders Federation (HBF) describes London as a “no-go zone for housing investment” because of high development costs, planning delays, and regulatory uncertainty. Developers have shifted focus to regional cities like Manchester and Birmingham, where the cost of building and risk of delay are lower, and investment returns are more predictable.

6. How are rising rents impacting Londoners?

London’s rents are the highest in England, with average monthly costs exceeding £2,100. More than 60% of renters say their housing costs are unsustainable. The surge in rents has forced key workers, young professionals, and families out of the city, contributing to a talent exodus and weakening London’s economic base.

7. What emergency measures has the government introduced?

The UK government and the Mayor of London have announced several emergency measures, including the Developer Investment Fund, temporary tax reliefs, and reduced affordable housing requirements (from 35% to 20%) for new projects. While officials say these steps aim to “get spades in the ground,” critics warn they could reduce the supply of genuinely affordable homes.

8. How does London’s housing crisis affect the economy?

The housing crisis is undermining London’s long-term growth. The lack of affordable homes is driving skilled workers and young professionals to relocate, shrinking the workforce and dampening productivity. At the same time, councils are spending over £4 million per day on temporary accommodation, straining public finances and diverting resources from other essential services.

9. What long-term solutions do experts recommend?

Experts are calling for a complete reset of housing policy — one that treats housing as essential infrastructure. They recommend simplifying planning rules, increasing public funding for social rented housing, regulating rent growth, and aligning national and local strategies to create genuinely affordable homes for all income levels.

10. What’s the outlook for London’s housing market in 2026?

Analysts expect London’s housing output to remain well below target in 2026 unless major reforms are introduced. Without deeper structural changes, the city risks a “lost decade” marked by stagnant construction, rising homelessness, and worsening inequality. The crisis could redefine London’s ability to remain a livable and competitive global city.

AnniWeston

AnniWeston